The Social Crusade of Employees State Insurance Corporation

Employees' State Insurance Corporation (ESIC), is an autonomous, self-financing social security and labor welfare corporation which was established as per the rules and regulations given in the Indian ESI Act of 1948, under Ministry of Labour and Employment, Government of India. Under the registration of this legal body or organization, employees can avail numerous benefits as per their needs and requirements, which is basically the statutory compliance in HR.

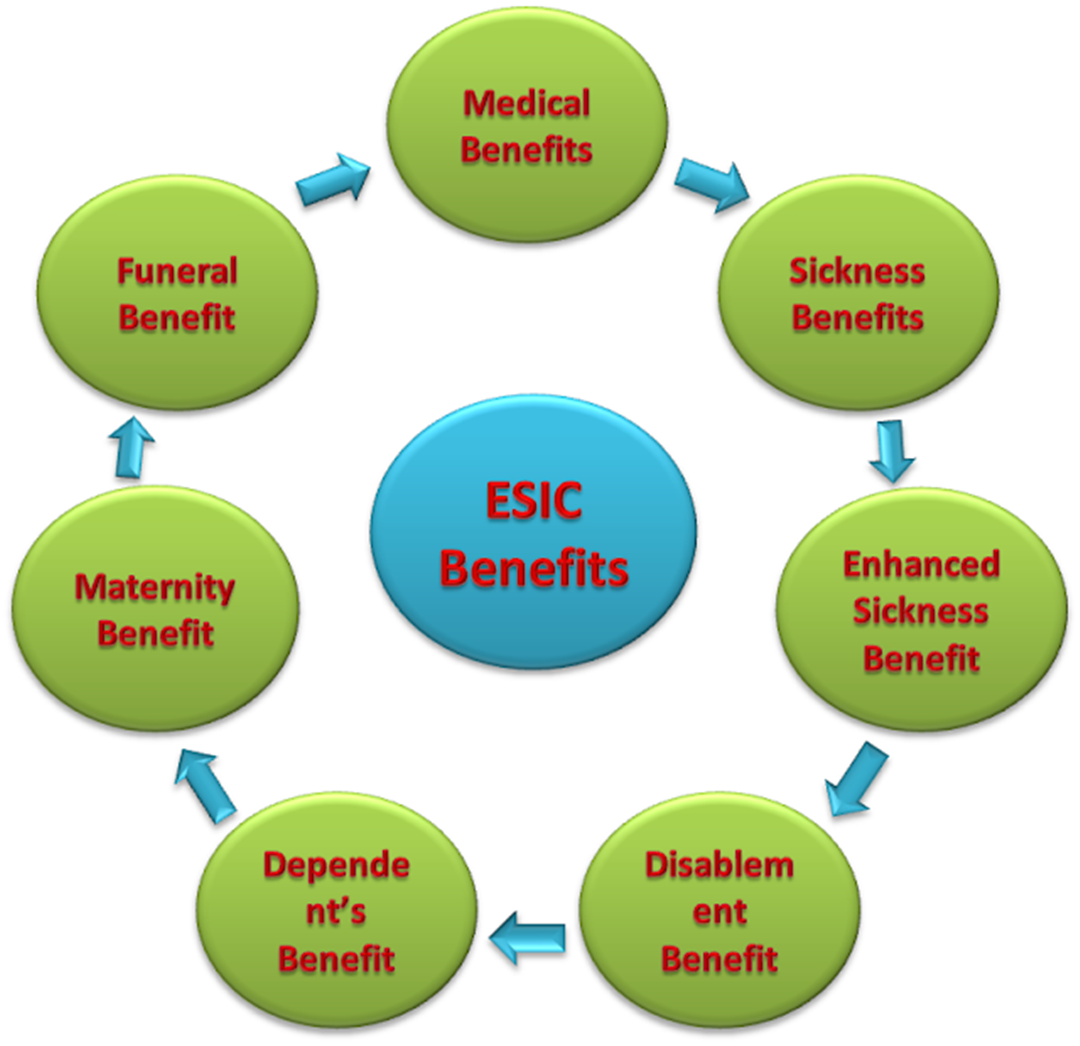

The Employees’ State Insurance Act, 1948 imparts an amalgamated need based social insurance scheme that helps to protect the interests of workers in times of dire need. Facilities such as these, enhance the performance, capabilities and also improves the health of the beneficiaries. To ensure the proper working of Statutory Compliance for ESI Fund a sturdy payroll services is a must. Let’s have a look at few of the its benefits-

Medical Benefit:

Usually caters to the needs of an employee, their spouses, and family. It allows abstention from work on medical grounds.

Sickness Benefit:

Under the section 46, an individual shall be given this benefit only when his sickness is certified by a medical practitioner or any other skilled person who would be specified by the corporation. This benefit is available not before three days of illness. Additionally the employee must have served at least for 78 days at work. In this, the insured person will eligible to received 70 percent of his salary in the given time period.

Enhanced Sickness Benefit:

For diseases pertaining to serious medical ailment like T.B, the employees are eligible for extended benefit. However, the employee must have served the company for at least 156 days in 4 consecutive work period.

Disablement Benefit:

This benefit is segregated into two types- Permanent Disablement and Temporary Disablement. In the Permanent Disablement if the employee’s injury makes him incapable for all work, he was capable of performing at the time of accident, he or she is provided with a periodical payment at a rate of hundred percent or as regulated by the Central government according to age. On the other hand, the Temporary Disablement is one which an employee sustains temporary accident or injury which has occurred for three days or more. The injured person is paid at a rate of ninety percent of total salary.

Dependent’s Benefit:

This benefit caters to the needs of dependents of an employee. In this, the said dependent is given the benefit if the insured person dies because of an employment injury. Under the dependent category, children under 25 years of age, a widowed mother, a widow and minor unmarried daughters can be considered.

Maternity Benefit:

A woman employee is entitled to this benefit in case of miscarriage, premature death of a child or illness arising due to pregnancy. The claim of this benefit, it’s time period and its condition will be regulated only by the Central Government, under the condition that the employee will contribute for 70 days of work in the upcoming year.

Funeral Benefit/Death Benefit:

After the death of an insured person, the eldest surviving member of the family is provided with an amount of 10,000 rupees for carrying out the funeral proceedings. The claim for this benefit has to be initiated within three months of death of the insured person. The Employees’ State Insurance Medical Officer keeps a record of the expenditure during the whole process.

The Employees’ State Insurance Corporation (ESIC) have raised the monthly wage limit from Rs. 15,000 to Rs. 21,000, for coverage with effect from 1 January 2017. In this, 1.75 percent share will be that of an employee, and 4.75 percent share will be contributed by an employer. A number of payroll outsourcing services are used by a company, such as software which make the work easier, and handy. In today’s fast paced, competitive world it is always benefits for a company to use payroll management software. Additionally, there are various payroll outsourcing companies, like Brooks Consulting, Sequel outsourcing private limited, etc. which makes the task comparatively easier by providing payroll outsourcing services.

Share with us